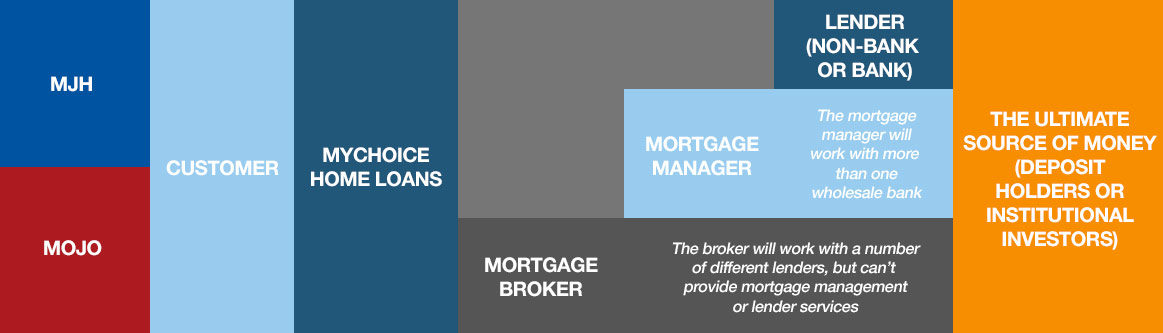

Mortgage Broking

It’s well known what a Mortgage Broker does; they act for the borrower and help them to compare a select range of lenders, help the customer prepare the loan application, lodge the application with the lender and act as a liaison point to work through the loan approval with the borrower. They may also assist the customer sign their loan and mortgage documents and return them to the lender in preparation for loan settlement. A Mortgage Broker is usually paid a commission for the referral by the lender. Once a loan settles, a Mortgage Broker has not further role in the ongoing relationship between the lender and the borrower.

Mortgage Management

A level above a Mortgage Broker, a Mortgage Manager works on behalf of a wholesale lender/bank and is the link between the bank and the borrower, managing the loan application process, approval, settlement and after settlement work and communication between the bank and the borrower. A Mortgage Manager is a specialised role and they usually work with more than one wholesale bank, as a result often offering better rates and a more flexible, personalised options for borrowers.

Non-Bank Lender

A step above a Mortgage Manager, a Non-Bank Lender takes on the credit risk associated with a home loan, and fills the role that a traditional bank does, but is not regulated as an Approved Deposit-Taking Institution. A Non-Bank Lender offers all services a Mortgage Manager does, however it is on their own balance sheet. As a result, they have the flexibility to create customised credit policies, processes and loan products that may differ from what banks are able to provide.